Introduction: The Allure of Cryptocurrency Mining

Cryptocurrency mining has captured the imagination of tech enthusiasts and investors worldwide. The idea of earning digital coins by contributing computing power to a global network is both exciting and empowering. But how do you actually start mining cryptocurrency? Is it still profitable in 2025? This guide will walk you through the process—from the basics to advanced tips—so you can confidently begin your mining journey, no matter where you live.

What Is Cryptocurrency Mining?

Cryptocurrency mining is the process of validating transactions and adding them to a blockchain, the digital ledger that powers coins like Bitcoin, Litecoin, and Dogecoin. Miners use powerful computers to solve complex mathematical puzzles. The first miner to solve the puzzle gets to add a new block to the blockchain and is rewarded with newly minted coins and transaction fees.

Mining is essential for maintaining the security and decentralization of cryptocurrencies. Without miners, digital currencies would be vulnerable to fraud and manipulation.

How Does Crypto Mining Work?

At its core, mining involves:

- Verifying transactions: Miners collect pending transactions from the network.

- Solving cryptographic puzzles: Using specialized hardware, miners compete to solve a complex mathematical problem (Proof of Work).

- Adding a block: The first miner to solve the puzzle adds a new block to the blockchain.

- Earning rewards: The successful miner receives a block reward (new coins) and transaction fees.

This process repeats continuously, keeping the blockchain secure and up-to-date.

Types of Cryptocurrency Mining

1. CPU Mining

- Uses a computer’s central processing unit.

- Was popular in the early days but is now largely obsolete due to low efficiency and high energy costs.

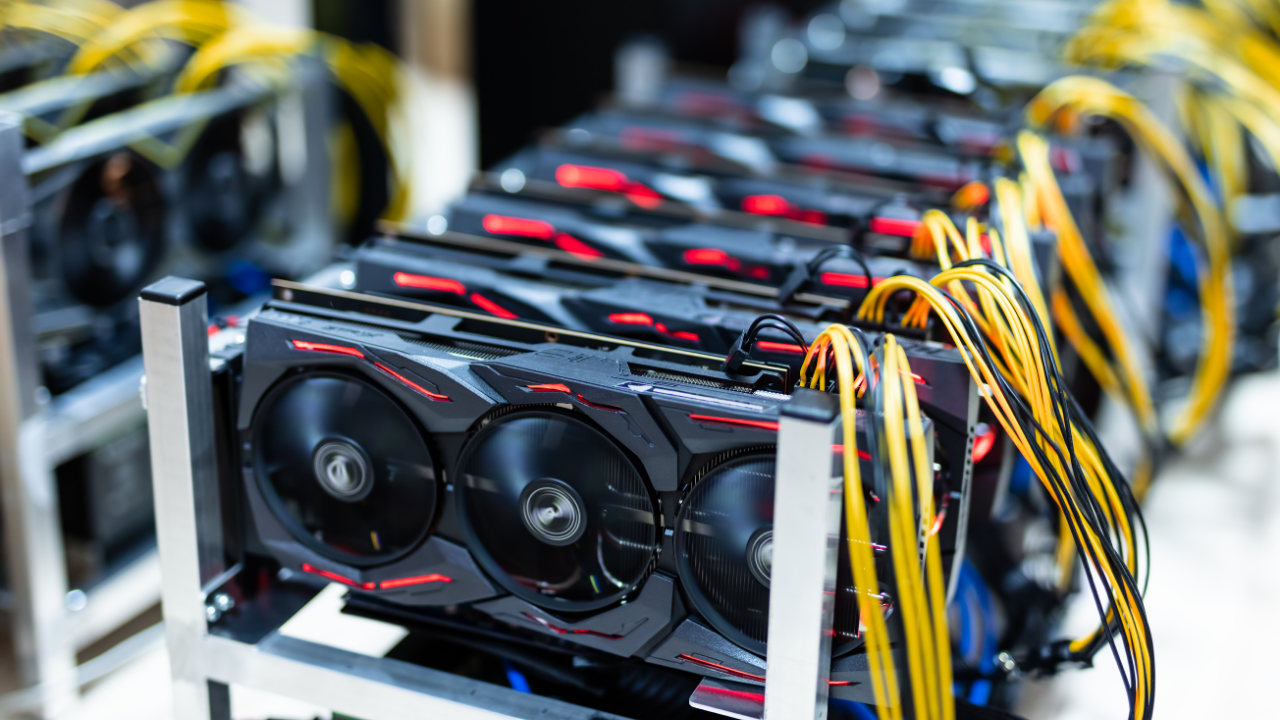

2. GPU Mining

- Uses graphics processing units (GPUs) for greater computational power.

- Suitable for some altcoins, but not competitive for Bitcoin anymore.

3. ASIC Mining

- Application-Specific Integrated Circuits (ASICs) are devices built solely for mining.

- Extremely powerful and energy-efficient for specific coins like Bitcoin and Litecoin.

- Higher upfront cost, but much better performance.

4. Cloud Mining

- Rent mining power from a company or data center.

- No need to buy hardware or manage maintenance.

- Beware of scams—research thoroughly before investing.

5. Mining Pools

- Join forces with other miners to increase your chances of earning rewards.

- Pools distribute rewards based on each miner’s contribution, offering more consistent payouts.

Step-by-Step: How to Start Mining Cryptocurrency

1. Choose Your Coin

Not all cryptocurrencies are equally profitable or suitable for beginners. Bitcoin is the most famous, but it’s also the most competitive. Consider alternatives like Litecoin, Dogecoin, Monero, or Ethereum Classic, which may be easier to mine with consumer hardware.

2. Get the Right Hardware

- ASIC miners: Best for Bitcoin, Litecoin, Dash, and Dogecoin.

- GPUs: Suitable for coins like Monero, Ethereum Classic, and Ravencoin.

- CPUs: Only practical for a few coins like Monero, but generally less profitable.

Research the hardware requirements for your chosen coin. Remember, powerful hardware means higher upfront costs but better mining efficiency.

3. Set Up a Crypto Wallet

You’ll need a secure wallet to store your mined coins. Options include:

- Hardware wallets: Most secure, store your coins offline.

- Software wallets: Convenient, but less secure than hardware wallets.

- Exchange wallets: Easy to use, but not recommended for long-term storage.

4. Download and Configure Mining Software

Mining software connects your hardware to the blockchain and, if you join one, a mining pool. Popular options include:

- CGMiner

- BFGMiner

- Awesome Miner

- MultiMiner

Choose software compatible with your hardware and operating system, and follow setup instructions carefully.

5. Join a Mining Pool (Optional but Recommended)

Solo mining is rarely profitable for beginners. Mining pools combine your resources with others, increasing your chances of earning rewards. Look for reputable pools with low fees and a good track record.

6. Start Mining

Once everything is set up, start your mining software and let it run. Monitor your hardware’s performance and watch your earnings grow over time. Keep an eye on temperature and electricity usage to avoid overheating and high costs.

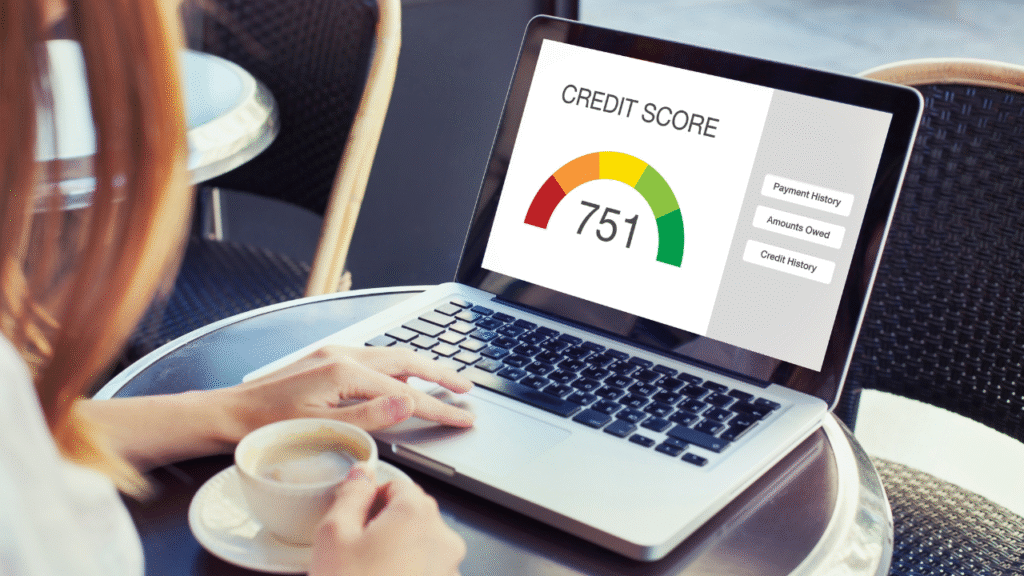

Key Factors That Affect Mining Profitability

- Electricity Costs: The biggest expense. Cheap power makes mining more profitable.

- Hardware Efficiency: Newer, more efficient miners yield better results.

- Mining Difficulty: As more miners join the network, solving puzzles gets harder.

- Coin Price: Higher coin prices mean bigger rewards.

- Block Rewards and Fees: These can change over time, especially after events like Bitcoin’s “halving”.

Best Cryptocurrencies to Mine in 2025

| Coin | Hardware Needed | Difficulty | Profit Potential | Notes |

|---|---|---|---|---|

| Bitcoin (BTC) | ASIC | Very High | Moderate | Best for large setups |

| Litecoin (LTC) | ASIC | High | Good | Merged mining with DOGE |

| Dogecoin (DOGE) | ASIC | High | Good | Often mined with LTC |

| Monero (XMR) | GPU/CPU | Medium | Good | Privacy-focused |

| Ethereum Classic | GPU | Medium | Moderate | After Ethereum PoS shift |

| Ravencoin (RVN) | GPU | Medium | Moderate | ASIC-resistant |

Tips for Beginner Crypto Miners

- Start small: Don’t invest heavily until you understand the process and costs.

- Do your research: Learn about scams, especially in cloud mining.

- Monitor your setup: Use software to track performance, temperature, and earnings.

- Stay updated: Crypto mining evolves quickly. Follow news and community forums for the latest trends.

- Consider the environment: Mining uses a lot of energy. Look for ways to reduce your carbon footprint, like using renewable energy sources.

Risks and Challenges

- High Electricity Bills: Mining can be expensive if power costs are high.

- Hardware Wear and Tear: Mining rigs run 24/7 and may need regular maintenance.

- Regulatory Changes: Laws and taxes can change, so stay informed about your country’s regulations.

- Market Volatility: Crypto prices can swing wildly, affecting profitability.

Conclusion: Is Crypto Mining Right for You?

Mining cryptocurrency can be rewarding, both financially and intellectually. However, it requires careful planning, investment, and a willingness to learn. For most beginners, joining a mining pool and starting with a less competitive coin is the best way to get started. Always weigh the costs, risks, and potential rewards before diving in.

Ready to Start Your Crypto Mining Journey?

If you’re excited about joining the world of cryptocurrency mining, take your first step today! Research your options, set up your hardware, and start earning digital assets. Remember, every successful miner started as a beginner—your journey begins now!